A Guide To Life Insurance for Over 50s in Australia

Key Points

Fewer than half of Australians have enough life insurance for their loved ones to maintain their current standard of living*.

You can still get affordable life cover over 50 -- many policies allow you to take out life insurance into your late 60s and early 70s.

As we age, we're sadly more susceptible to injury and illness, and therefore more likely to need a payout from life insurance to cover our expenses.

As we get older, we start to think more about the future.

That means putting in place safeguards to secure our way of life - for ourselves and our loved ones - as well as getting the right level of insurance.

But that doesn't mean that if you're over 50, and don't yet have a life insurance policy, it's too late.

In fact, getting the right level of cover is easy with Compare Club.

But it's a topic that it pays to be informed on.

So, let's explore what life insurance is and how it can protect you.

Compare & SaveWhat is life insurance?

Life insurance is a policy that acts as a financial security blanket for you and your loved ones.

If something unexpected happens, from being diagnosed with a serious illness, to being unable to work due to an accident or sickness, to passing away; life insurance will reduce some of the financial burden by paying either a lump sum or part of your income to a beneficiary.

This is often paid to your partner or children, depending on your level of cover and your chosen policy.

If you decide to get life insurance, you'll probably say you want the best policy on the market.

It sounds simple but there are a lot of different insurers, and everybody's need is slightly different.

However, if you're over 50 and getting life insurance for the first time, or took out a policy years ago and it doesn't cover your needs then read on - there's a lot of specific questions you can ask and ins and outs of policies that it's worth knowing about.

And one early tip, if you have got life insurance, it's important to read the Policy Disclosure Statement so you understand exactly what your life insurance covers you for.

This is different for every insurer.

Why get life insurance after 50?

When you reach the age of 50, it's natural to start thinking about retirement, even if you've got many more years of work in you.

After all, retirement should be your golden years where you should be enjoying life to the full.

But it's also important to be financially secure. After all, nobody would want to spend their retirement scraping around to have enough to live.

And you definitely don't want your partner or children to be impacted if you're no longer around or can't work.

But research from consultancy, Rice Warner, found that only 42% of Australians have enough life insurance for their family to maintain their current standard of living*.

That means the majority of Australians who unexpectedly lose a loved one may endure financial difficulties.

Life insurance can eliminate that worry and give you peace of mind. It's also affordable -- even after you turn 50.

Here's a two reasons why it's worth considering:

1. It protects your way of life

Think about what would happen if you passed away unexpectedly, or were unable to work (and earn a living) due to illness or injury.

How would your dependents survive financially? Who would pay the mortgage? Would bills go unpaid or would there be less food on the table?

Life insurance is a simple solution that can protect those you love most if the worst should happen.

2. We are more prone to the unexpected as we age

An unfortunate fact of life is that over-50s are more likely to suffer a serious incident that will require a payout on life insurance.

As we age, our bodies aren't as strong and resilient as they were in our younger years.

Figures from Safe Work Australia** found that those aged 55 and over were more likely to make a serious claim from a disease or injury acquired at work -- and the number of claims is growing year-on-year.

We are also more prone to the unexpected no matter what we're doing - in fact, as we get older our immune system starts to deplete^, which can mean we're more susceptible to illness and disease.

Getting life insurance acknowledges the realities of getting older and can put in place the right safeguards to financially protect yourself and your loved ones in case of the unexpected.

What type of life insurance features are useful for over-50s?

There's no one-size-fits-all approach to life insurance, so you'll want to take out the policy - or policies - that best suits your circumstances.

Here are some of your options.

Over-50s life insurance

Term cover - also known as life cover or sometimes the more morbid death cover - is probably what you think of when you hear the words 'life insurance'.

It's a policy that pays out a lump sum in the event of your death or if you're diagnosed with a terminal illness.

If you want to take out life insurance when you're over-50, you'll need to get a policy before you're 75.

A quick note here: the maximum age varies depending on the provider.

And if you're 65 or over, you might want to head to our life insurance guide for Australian seniors.

So how does age affect life insurance?

Well, it's important to note that term cover premiums generally increase as you get older.

If you are struggling to justify paying higher premiums for the same insurance every year, you might be able to put a freeze on them.

This allows your premiums to stay the same price but the level of cover will reduce each year.

Also, term cover isn't just a set-and-forget purchase.

If you already have life cover, or feel like you're paying too much, you can always use a service like Compare Club to see if there's a more affordable policy on the market.

Income protection insurance for over-50s

You might think because you're over 50 that you don't need income protection insurance.

But according to the Grattan Institute, half of working Australian households have less than $7,000 in the bank^^.

And if you fall ill or get injured and can no longer work, your savings could quickly be eaten up, making it harder to provide for your family or keep up with your bills.

This is where income protection kicks in.

Generally, income protection insurance for over-50s will provide you with 70% of your monthly income for a set period, according to your policy.

This means you can continue paying the mortgage, put food on the table and take care of education costs for your kids without worrying about not having any money coming in.

Trauma insurance for over-50s

Also known as critical illness insurance, a trauma insurance policy will make a lump-sum payout if you are diagnosed with a critical illness.

There's a set number of illness that are covered by trauma (read our guide for more detail)- these tend to include common but serious and unexpected illnesses such as:

Heart attack

Stroke

Cancer

In terms of age, you need to purchase this type of life insurance before you are 65 as many insurers don't offer this type of policy once you hit this age.

It's also worth noting that most trauma insurance policies expire after you turn 70.

Total and permanent disability (TPD) insurance for over-50s

While the pension age won't be raised to 70 just yet, it's clear that the rising cost of living is contributing to Australians working longer and putting their retirements on hold.

As mentioned earlier, sadly over-50s are more susceptible to illness and injury as you age -- and workplace injuries are common.

This is where total and permanent disability (TPD) insurance kicks in if you are forced out of work.

If you suffer an injury or illness that affects your ability to work, TPD insurance will provide a payout to help you cover the general life expenses that your wage would typically pay for.

It's worth noting that there's a number of different tests used by insurers to determine whether or not they'll pay out.

The main test you'll hear of is called the Activities of Daily Living (ADL) test.

Essentially this means you'll need to show that you can't perform two or more of a number of activities of daily living by yourself.

These generally include:

Feeding yourself

Walking

Dressing

Getting out of bed

Washing and using the bathroom

Depending on the policy, you may be covered for 'own occupation' or 'any occupation'.

Any occupation is when you cannot perform any role that you might be qualified to do.

Own occupation is when you can't perform the specific role that you can't return to your usual occupation.

So if you work a retail role that requires you to be on your feet all day, and due to illness or an accident you're unable to walk, own occupation would cover you for this role, while any occupation may not pay out if you could perform a role in the retailer's call centre.

As you can guess from the name, TPD protects you if you can't return to work at all.

It differs from Income Protection, which only covers your wages for a set period of time.

So if you work in construction, a broken arm may put you out of action for a few months, which is where Income Protection would cover you.

But if you had a heart attack and your doctor said you could no longer work and you satisfied the tests that your insurer uses, then that's where TPD comes in.

That said, Income Protection would also still cover you in a situation where you were unable to work due to a heart attack but were waiting for your TPD claim to be assessed, or if your TPD claim was refused.

The top TPD benefit for over-50s is that you are financially protected as your risk level for illness and injury at work rises.

That means you can rest easy knowing even though you still intend to continue working, you will be financially covered in the event you are no longer able to earn a living due to illness or injury.

Compare & SaveAre there different ways I can pay for life insurance?

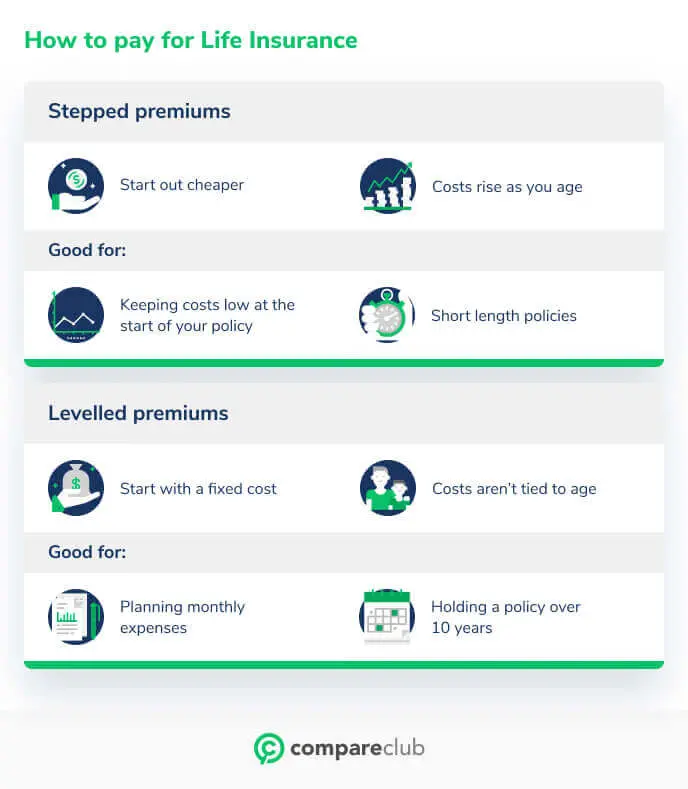

There's two types of life insurance premiums: stepped and levelled. They're different ways to pay.

Stepped premiums

Stepped premiums usually start out cheaper and become more expensive as you get older.

They're typically taken out when people don't want to impact on their cash flow early, and tend to increase significantly the older you get.

Levelled premiums

Levelled premiums are a fixed cost that aren't tied to your age (although may go up if your insurer puts their premiums up overall).

They typically start out more expensive but can provide more value for money over the long term.

How to pay for Life Insurance

Which premium is right for you.

It depends on your circumstances and how long you're holding the policy for - it may work out cheaper to hold a levelled premium for over 10 years.

For over-50s, the difference between the two may become narrower -- and we'll all hopefully be around well into our golden years.

Our team at Compare Club can do the sums for you, so you can choose which you think will provide you better value.

Are there other types of insurance for over 50s to consider?

Whether they pass away from natural causes in older age or they die unexpectedly, losing a family member or loved one is an emotionally difficult time.

Those worries are compounded even further when it comes to making arrangement for funerals, which are more expensive than most Australians expectº -- think about the burial plot or cremation costs, the casket, flowers, funeral director, space hire, as well as the cost of setting everything up for the day.

Funeral insurance is a way to reduce the risk of leaving a financial burden to your loved ones after you pass away.

Most policies will pay out anywhere from $3,000 to $15,000 to cover your funeral expenses.

However, a note of caution here.

A lot of funeral-specific policies can actually end up costing you more than the overall cost of the funeral, many of them aren't great value for money, plus come with a lot of restrictions, so you'll need to do your research if you're determined to have funeral cover.

There is an alternative though: a lot of term cover policies also include funeral benefits and may work out cheaper than a straight funeral policy.

How much does life insurance cost for over-50s?

It's the question you've probably been waiting for.

However, the long answer is it depends on a range of factors, such as your age, which type of life insurance you choose, your provider, your medical history and even where you live.

It's going to be different for everyone - no two people's needs or lives are the same - but to help give you a general idea of costs, below is the monthly average premium (correct as of 30 July 2020) for a single non-smoking 50-year-old male office worker in NSW looking for $500,000 worth of separate life cover, Income Protection, Trauma and TPD.

A quick note: your premiums may be lower or higher even if you have a very different life state and dependents to our example.

Meet Tony, a single non-smoking 50-year-old office worker from NSW.

This is how much $500,000 of different types of life insurance might cost him in monthly premiums*

Term cover | $69.46 |

Income protection | $240.74 |

Trauma | $343.11 |

TPD | $87.98 |

Compare & Save* average costs taken from life insurance comparison's panel of insurers on 30.07.20

Can I apply for life insurance without having to take a medical exam?

Yes, getting the best life insurance for your needs is very simple -- and you won't have to visit a doctor to take a comprehensive medical exam.

However, when seeking out your over-50s life insurance plan through Compare Club, you'll need to answer a series of medical questions when you apply.

This is so our expert team can find the right policy options for you -- matching your lifestyle and your insurance needs.

What if my application for life insurance has been refused and I am over 50?

Sometimes when you apply for life insurance directly with a provider you will be refused.

It may be due to your medical background, your age or another reason.

It can be disheartening and you might feel like it's not worth looking for another over-50s life insurance policy, especially if you've put a lot of time or effort into researching policies.

It's where third-party services, such as our team at Compare Club, come into their own.

Our team of experts will scour the market from a panel of insurers to find other options for you.

How can I get over-50s life insurance?

There's a number of ways of getting life insurance.

You can buy direct with the insurer, although you'll also have to do your own research if you want to compare prices and policies, and this can be a time consuming process.

Many super funds also offer forms of life insurance through your superannuation, although there's a few caveats here, as they generally tend to be less comprehensive than policies purchased through a retail or specialist insurer.

Also, payouts will go directly into your super, which can make it difficult to access.

You can also go through a broker or financial advisor who'll assess your situation and offer guidance on the best policy for your needs.

There are some brokers who operate on a commission basis, though, so it's worth checking if you need as much insurance as they're recommending.

We're proud to say our life insurance specialists don't get paid for recommending specific products, so our goal is simply to find the best deal and policy for your situation.

Simply enter a few details and we'll get you instant quotes from ten of Australia's leading insurers.

We break down the prices, the features and the policies so you have all the information you need to make a decision.

And you won't have to worry about dealing with any red tape -- we'll even negotiate the rate on your behalf.

But what if you're worried about getting paid out on a claim even if you are accepted for life insurance?

Well, retail life insurers, such as those on our panel, pay out in 97% of life insurance claims.

That means you can get peace of mind knowing that your future and your legacy will be protected should the unexpected occur.

How to start comparing life insurance policies

Ultimately, it's never nice to think about your passing, or a serious illness or injury, and how it could impact those you care about most, but it's a good idea to take the necessary steps to protect them financially.

With Compare Club, we'll take all the stress out of finding the perfect policy among the best life insurance companies in Australia -- even if you're over 50.

Compare & SaveThe information contained in this guide is of general nature only and has been prepared without taking into consideration your objectives, needs and financial situation. As such, it is important that you consider the appropriateness of any advice and the relevant product disclosure statement (PDS) before proceeding. Check with a financial professional before making any decisions.

Rice Warner & Choice: Undercovered report, 2014* *Safe Work Australia, Disease and injury statistics by age, March 2020* ^ Journal of Clinical Investigation, Causes, consequences and reversal of immune system aging, March 2013^^ Grattan Institute, As the COVID crisis deepens few Australians have much cash in the bank, March 2020º Choice, How much do funerals cost, September 2019.